Podcast Discussion: Deep Dive Into This Article.

Solana continues to solidify its position as a leading blockchain platform, achieving remarkable milestones across DeFi, staking, and market performance. In this recap, we explore the latest highlights that underscore Solana’s rapid ascent in the crypto space. From record-breaking decentralized exchange (DEX) volumes to its all-time high price of $265, Solana’s ecosystem is thriving with innovation and strong investor confidence.

1. Solana DeFi Ecosystem Achievements

- DEX Milestone: Solana’s decentralized exchange (DEX) ecosystem surpassed $100 billion in monthly trading volume for the first time in November 2024, nearly doubling Ethereum’s DEX volume.

- Capital Inflows: Over $300 million transferred from other blockchains (notably Ethereum) to Solana, reflecting robust investor confidence.

- Rising TVL: A 13.4% increase in total value locked (TVL) now at $7.6 billion, with protocols like Jito and Marinade drawing significant inflows.

- Top Protocol Growth: Five protocols – Jito, Kamino, Raydium, Jupiter, and Marinade – are on track to surpass $2 billion in TVL for the first time in three years.

- Innovative Projects: Exponent Finance raised $2.1 million to build Solana’s first DeFi fixed-rate market.

- Phantom Wallet Expansion: Phantom acquired Blowfish to enhance its DeFi offerings.

- New Stablecoin Launch: Sky Ecosystem introduced the USDS stablecoin on Solana.

2. Price Action Analysis

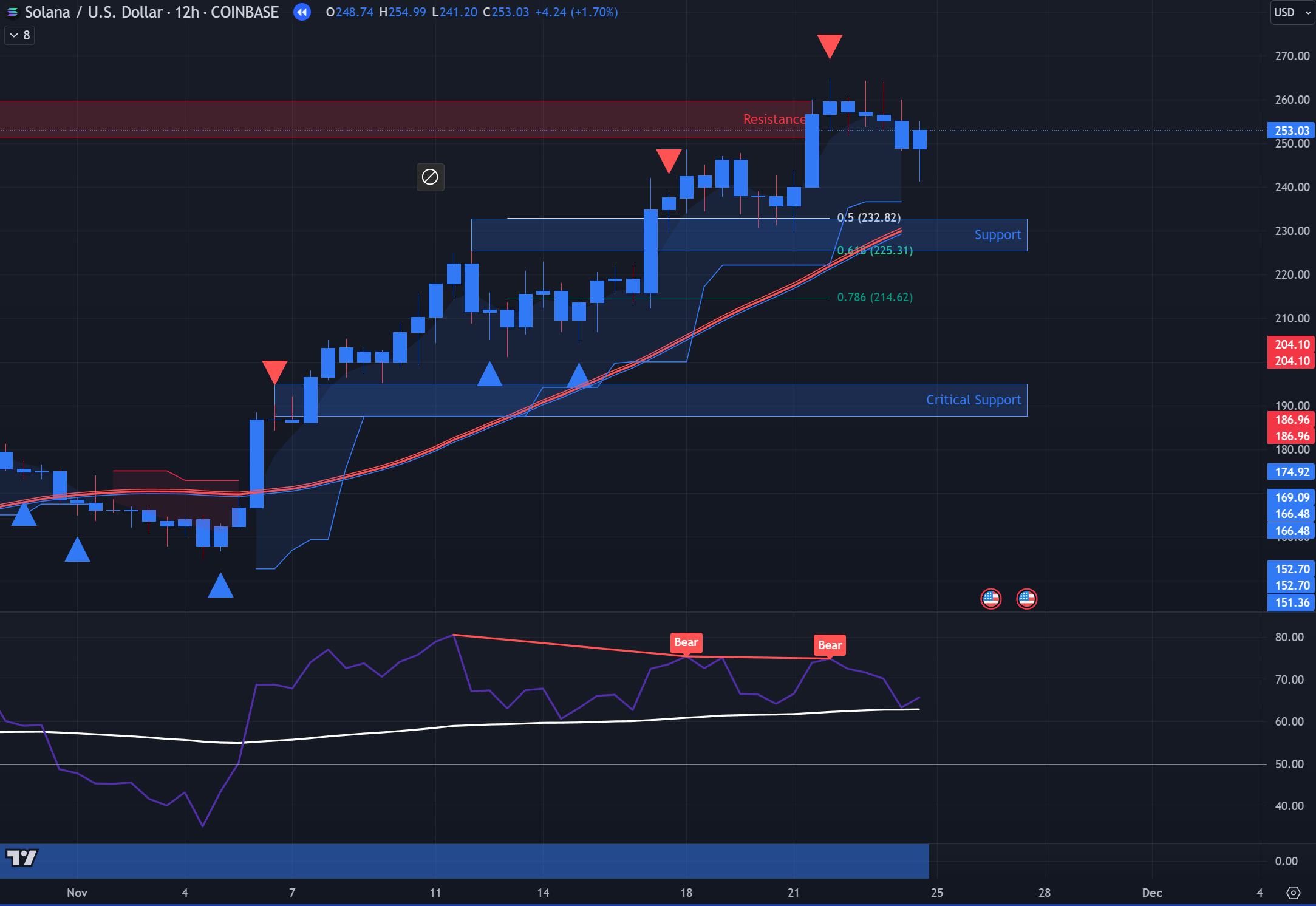

- Technical Signals:

- Bearish divergences on the RSI and a TD Sequential Sell Signal (TDSS) on the daily chart suggest a potential slowdown in momentum.

- Support at $225 could lead to a retest while higher timeframe bases form.

- Support at $190 remains a bullish pivot point.

- Market Sentiment:

- Funding Rate Heatmap: Indicates fuel for further upside. Current conditions are less overheated compared to the March 2023 peak.

- All-Time High: $SOL hit a new price ATH at $265 on the Coinbase spot chart, marking a 3200% increase from the post-FTX lows.

3. Comparative Liquidity Insights

- Solana now holds more BTC liquidity than Ethereum, enabling swaps with less price impact compared to ETH.

4. Staking and Yield Opportunities

- Liquid Staking Strength:

- MSOL (liquid staked SOL) is up 3672% from bear market lows, demonstrating the resilience of liquid staking and shows the power of staking your Proof of Stake assets.

- Yield Highlights:

- Staking Yields: Reports indicate up to 14% APY on staking due to increased ecosystem activity.

- Stablecoin Yields: DeFi protocols like Drift, Kamino, and Save offer stablecoin yields of approximately 20% APY for USDC and PYUSD with peaks at almost 40% APY.

5. Broader Implications

- The continued growth in Solana’s DeFi sector underscores its resilience and adaptability post-FTX collapse.

- Strategic developments like Phantom’s Blowfish acquisition and Exponent Finance’s fixed-rate market reflect a maturing ecosystem capable of supporting diverse financial products.

Conclusion

Solana is showcasing exceptional growth across its ecosystem, from DeFi to staking, while demonstrating strong price action and liquidity advantages. Despite bearish divergences signaling a potential pause, the network’s fundamentals remain robust, with ample upside potential and sustained innovation fueling its success.

This article reflects the opinions of the publisher based on available information at the time of writing. It is not intended to provide financial advice, and it does not necessarily represent the views of the news site or its affiliates. Readers are encouraged to conduct further research or consult with a financial advisor before making any investment decisions.