Podcast Discussion: Deep Dive Into This Article.

Breaking News: Beijing’s Stablecoin Pivot

On August 21, 2025, Reuters reported that China may soon legalize yuan-backed stablecoins, marking a potential reversal of its longstanding cryptocurrency ban. Sources close to the State Council indicate this move aims to accelerate the yuan’s global adoption, directly challenging the U.S. dollar’s 47.19% dominance in international payments, per SWIFT data from June 2025. This development aligns with China’s strategy to harness financial innovation while maintaining tight control, leveraging hubs like Hong Kong and Shanghai.

Hong Kong’s new stablecoin ordinance, effective August 1, 2025, and Shanghai’s digital yuan innovation center underscore this calculated approach. With U.S. dollar-pegged stablecoins holding over 99% of the market (Bank for International Settlements data), Beijing seeks to counter this imbalance amid rising geopolitical tensions in digital finance.

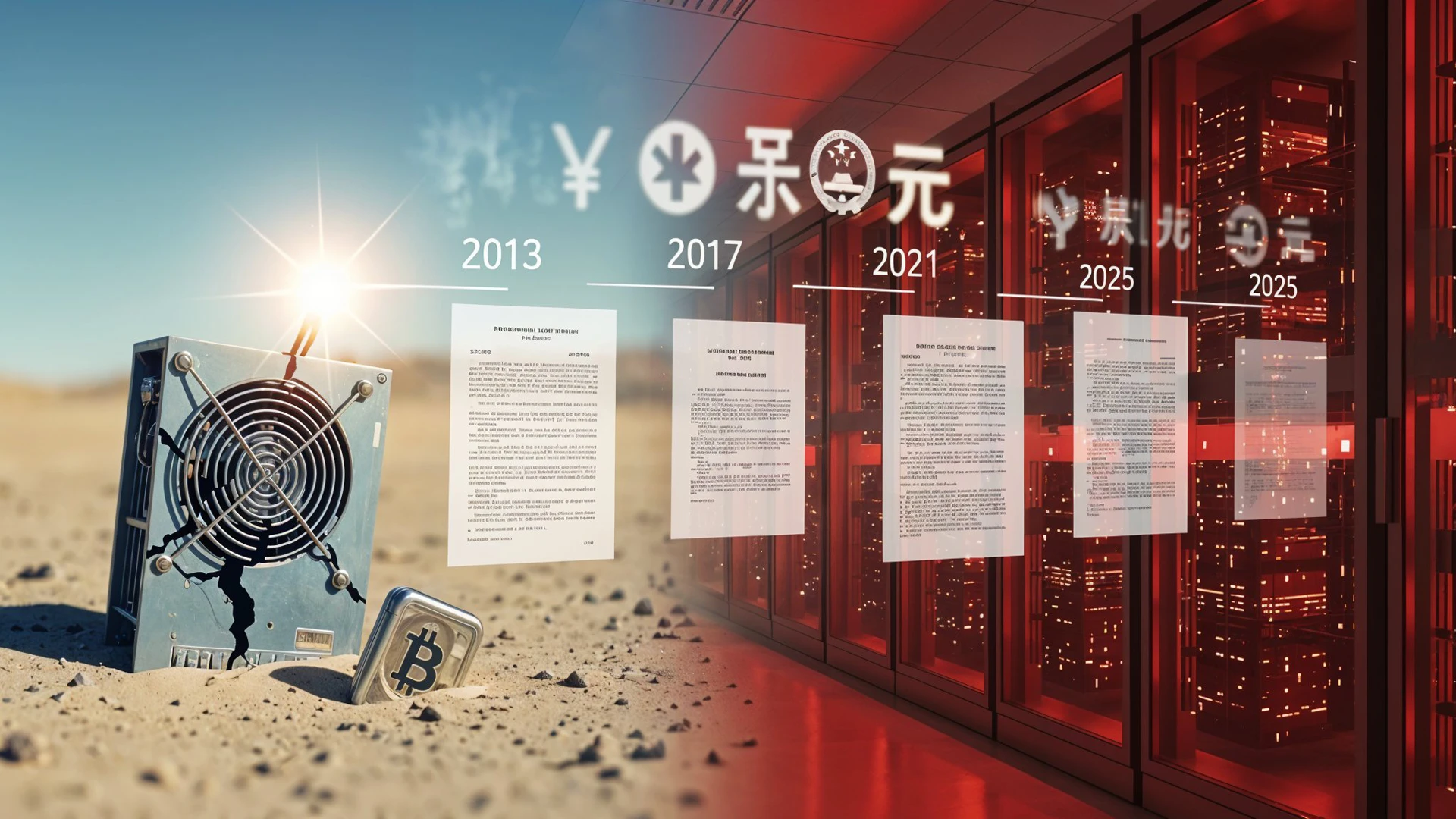

A Decade of Bans: From Early Warnings to Full Crackdowns

China’s crypto journey has been defined by repeated restrictions, starting small and escalating to comprehensive bans. These measures targeted risks like capital flight, speculation, and energy waste.

- 2009: Virtual currencies were barred from real-world purchases, an initial curb on digital tokens eroding traditional economic boundaries.

- 2013: The People’s Bank of China (PBOC) blocked banks from Bitcoin transactions, triggering a market plunge and limiting institutional involvement.

- 2017: Initial coin offerings (ICOs) were outlawed, and all domestic exchanges shut down. BTCChina, once handling 80% of global Bitcoin trades since its 2011 launch, ceased operations on September 30, 2017, symbolizing the end of China’s exchange dominance.

- 2021: Mining was banned nationwide for environmental reasons, and all crypto transactions declared illegal, forcing miners abroad.

- 2025: A May report hinted at banning personal crypto ownership, but it largely reaffirmed prior policies. China has issued at least 19 restrictions since 2013, fueling global market volatility.

These actions created “FUD” (fear, uncertainty, doubt) waves, but the industry adapted by relocating operations.

Institutional Openings: Hong Kong’s Pilot Programs Signal Change

While mainland China enforces bans, Hong Kong has embraced regulated crypto for institutions since 2023, testing innovations under “one country, two systems.”

- 2023: The e-HKD Pilot Programme launched, involving 16 firms to explore tokenized assets and stablecoins for wholesale and retail use. The Securities and Futures Commission (SFC) provided guidance for intermediaries on crypto activities.

- 2024: Phase two expanded to programmable payments and tokenized deposits. Crypto derivatives trading opened for institutions.

- 2025: SFC’s regulatory roadmap emphasized safeguards. Investment visas now accept Bitcoin and Ether for net worth proof. The Stablecoins Ordinance licensed fiat-referenced tokens, with pilots like HKT-Hex Trust for issuance. Tokenized funds debuted, including China Asset Management’s in February, backed by a HK$500,000 Web3 funding program in June.

These pilots attract global players, fostering yuan internationalization without retail risks.

Geopolitical Stakes: Racing for Digital Dominance

The stablecoin proposal echoes U.S. shifts, like President Trump’s January 2025 endorsement of stablecoins. It positions China in a fintech arms race, potentially reshaping global payments. Yet, full implementation hinges on regulatory tweaks, with retail crypto still off-limits.As trials evolve, this pragmatic pivot could redefine China’s role in crypto, from enforcer to innovator, while prioritizing state control.

This article reflects the opinions of the publisher based on available information at the time of writing. It is not intended to provide financial advice, and it does not necessarily represent the views of the news site or its affiliates. Readers are encouraged to conduct further research or consult with a financial advisor before making any investment decisions.